Did you know that on a $400,000 home, you could be leaving $450,000 behind when you use traditional financing?

Banks end up receiving more than half of your home sale’s profit. With HonestDeed’s safe seller financing platform, you can earn 1.5-2x more on your home sale while closing in days.

Relax and live out your retirement dreams while we protect your seller financed investment.

Use our calculator to see the additional cashflow you can earn with HonestDeed’s safe seller financing platform.

With HonestDeed, unlock your home sale’s full potential while remaining protected through the agreement.

Tax Advantages

Installment payments optimize your taxes over time vs capital gains tax on a lump sum payment

Safety & Protection

Default protection and assistance, plus quarterly buyer credit and financial health monitoring

Liquidity

Receive buyer’s down payment, & up to 20% of the outstanding balance

Support

Access to a dedicated customer support rep to asnwer all your questions

Cashflow Preservation

Payments scale up as interest rates scale down; motivating buyers to stay in the deal

HonestDeed protects your home sale investment

At HonestDeed, we know your home is one of your most important and largest assets. We take protecting the sale and the investment from it very seriously. That’s why we built innovative safety and protection measures within our seller financing platform.

With HonestDeed, we:

Vet your buyer so you can feel confident entering into an agreement

Run a financial health check on your buyer every 90 days to check for any signals of an upcoming missed payment. Our goal is to proactively get ahead.

In the rare case of default, HonestDeed handles removing the buyer from the home and giving you back your most important asset, your home.

If the buyer does default, we guarantee your payments for up to a year while we work to get your home back and resold.

HonestDeed is committed to keeping your investment safe and protected.

With HonestDeed, you get:

Through vetting process of your buyer so you can feel confident entering into an agreement

Run a financial health check on your buyer every 90 days to check for any signals of an upcoming missed payment. Our goal is to proactively get ahead.

In the rare case of default, HonestDeed handles removing the buyer from the home and giving you back your high value asset, your home.

And if the buyer does default, we guarantee to you your payments for up to a year while we work to get your home back and resold.

HonestDeed is committed to keeping your investment safe and protected.

Let’s run your numbers

Input Preferred Terms

Calculate & Adjust

Download & Share

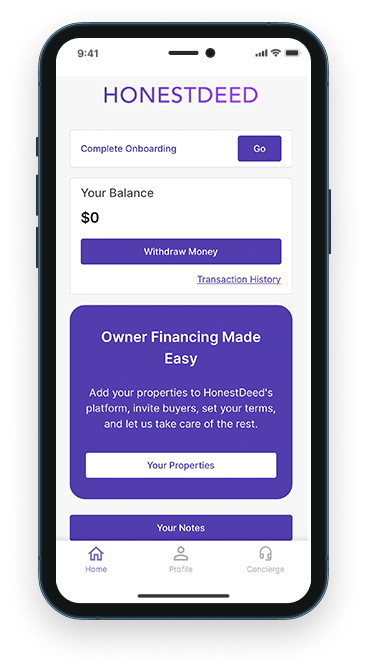

Step 1: Download our app

Sign up

Verify yourself

Set your profile

Step 2: Add your home

Verify your property

Set preferred terms

Await

approval

Step 3: Market the property

Receive

Welcome Kit

Market your property for sale; Realtor or FSBO

Engage potential buyers

Step 4: Review & Negotiate

Review offers

Invite & vet buyers

Negotiate final

contract

Step 5: Close

Execute agreements & close

Provide keys to the buyer

Start receiving

cashflow

Using HonestDeed’s seller financing platform allows you to safely, secure a monthly income for years. Plus, our process will make the entire experience stress-free.

Traditional Mortgage | Traditional Seller Financing | HonestDeed | |

Quick close; days not months | |||

Lump sum VS investment income | |||

Capital gains tax effecient | |||

Higher certainty to close | |||

Personal concierge | |||

Fully digitized experience | |||

Borrower Credit Transparency | |||

Liquidity (secondary market) | |||

Proprietary planning tools |

Join us today

We’ve been working hard building and designing our seller financing solution. We’re currently launching in Texas and can’t wait for you to try it. Sign up below for updates or to get your questions answered.